Burning the Midnight Oil for Living Energy Independence

We are in the Lame Duck Period. We have real unemployment rates of approximately 14% (counting headline unemployment, marginally attached, and involuntary unemployment as roughly 50% employed, 50% unemployed), and if the economy still sucks this bad in November in two years times, all manner of absurdly idiotic reactions could be elicited from an angry electorate by skillful corporate marketers.

We are in the Lame Duck Period. We have real unemployment rates of approximately 14% (counting headline unemployment, marginally attached, and involuntary unemployment as roughly 50% employed, 50% unemployed), and if the economy still sucks this bad in November in two years times, all manner of absurdly idiotic reactions could be elicited from an angry electorate by skillful corporate marketers.And if the the Republicans are willing to sabotage the security on loose nuclear bomb making material for political gain, surely they will sabotage the economy, as they have been doing.

And with transportation from the Recovery Act creating 630,000 direct and indirect jobs ~ a larger share of jobs than share of funding ... attacking transport funding is a critical step in sabotaging the economy.

So, an idea on what can be done about it.

_________________________________________

The Highway Trust Fund needs money

The central problem facing transport is "revenue" or, to use a five letter word, taxes. We have a Federal gas tax that has been frozen at under $0.19 over the last decade, with no adjustment for inflation, while on the other hand, the Federal Highway Trust Fund is facing escalating demands on its funding.

The central problem facing transport is "revenue" or, to use a five letter word, taxes. We have a Federal gas tax that has been frozen at under $0.19 over the last decade, with no adjustment for inflation, while on the other hand, the Federal Highway Trust Fund is facing escalating demands on its funding.The problem is more than just the lack of an inflation adjustment, but its still fairly straightforward. When the Highway Trust Fund was launched, it was to be directed to Interstate, US, State, County and Township Highways ~ in other words, to most roads used in suburban and rural areas, but excluding most roads used in urban areas.

Of course, when it was launched, we had a dominant share of motorists doing most of their driving on unfunded city streets. So there was a tremendous cross-subsidy provided from urban street driving miles to rural and suburban roadworks.

And as we are all aware, this cross-subsidy is one of the things that promoted the growth of new rings of suburbs, and then outer suburbs.

So the share of the driving on subsidized roads has been increasing while the share of driving on subsidizing roads is shrinking. And the growth in use of the subsidized roads implies a delayed-fuse financial time bomb in terms of a growing maintenance cost over time.

And while the cost of maintaining our road system will be growing over time, a fixed dollar value Federal gas tax implies a shrinking amount of resources that can be devoted to the maintenance.

And each oil price shock that hits will:

- Generate inflation, reducing the maintenance resources that can be bought with a given Federal Gas Tax dollar

- Promote greater fuel efficiency, including pluggable hybrid electric vehicles that with care can get much of their driving done on electricity alone, and

- Encourage use of oil-independent vehicles, such as all electric cars, which pay no gas tax at all.

So the roads need a new source of revenue.

Oil Independent Transport Needs Money

In January, a new Republican House is coming into place, elected on a platform of running the country out of the fantasy and science fiction section of a particularly understocked Barnes and Noble, and as reported at The Transport Politic (hint: bookmark) may be:

In January, a new Republican House is coming into place, elected on a platform of running the country out of the fantasy and science fiction section of a particularly understocked Barnes and Noble, and as reported at The Transport Politic (hint: bookmark) may be: A New Political Reality Settling In For National Transportation Financing

Tanya Snyder of Streetsblog Capitol Hill broke the news last Friday that House Republicans are planning to push to "stabilize" the Highway Trust Fund by cutting back expenditures to meet revenues without raising any taxes in the process. The result would be a large decrease in overall federal transportation funding — a potential reduction in spending by $7 to 8 billion a year from around $50 billion today. According to Snyder’s sources, transit financing would be hit especially hard, seeing its annual appropriation cut from $8 billion to $5 billion.

...

Of course, investment in oil-independent transport is required by the objective situation we are facing ~ on national defense and business development grounds, as well as on ecological sustainability and Climate Chaos ground ~ and investment in oil-independent transport at this point in time would also generate much needed fresh employment in the short term. And since it insulates the economy from oil-price-shock inflation over the long haul, that is short term stimulus combined with long term inflation reduction and increased national standard of living.

Now, if it were for long term benefit at substantial short term pain, the House Republicans in the next session might allow the Democrats to pursue it. But long term benefit combined with short term gain absolutely contradicts the priority number one of sabotaging the Obama administration going into its re-election campaign.

So if we are going to have any funding for oil-independent transport over and above the just under 3 cent Federal Transit portion of the Federal Gas Tax, we need to get that funding lined up during the Lame Duck.

The Strange Politics of an Crude Oil Import Tariff

An increase in the gas tax during the Lame Duck is not going to get done.

However, there is an alternative source of oil-tax funding that has rather peculiar politics. That is the tariff on oil-imports.

We import roughly twice what we produce, so crude oil prices in the US are driven by the price of import oil. Therefore, a tariff on oil-imports provides windfall gains to oil produced in the United States, equal to the size of the tariff.

And the US oil producers are part of the entrenched opposition to an increase in the gas tax. ... But windfall gain ... but opposed to gas tax ... but windfall gain ...

... Louisiana oil production, Texas oil production, Alaska oil production, Montana oil production ... windfall gains ...

I don't know if it can be pushed through, but looking at that list of windfall gain recipients above, its the only form of oil revenue that I can see having a prayer of a chance.

And the Republican Party has invested massive rhetorical resources into the bullshit "Drill Baby Drill" frame ... but an import crude oil tax slides right into that frame, "encouraging exploration for our own domestic oil".

Split a Penny in Half

So, this is the idea. Add a 1% tariff on imported crude oil. Crude oil is not a "scheduled commodity" in the WTO system, so we are free under the WTO to put any tariff rate we want to.

Split the proceeds in half:

- Half goes to a special "maintenance fund" in the Highway Trust Fund, distributed by standard formula, but restricted to maintenance of existing Interstate, US, State, County and Township Highways

- Half goes to an Oil Independence Infrastructure Bank, to finance infrastructure projects that offer a demonstrable reduction in the oil dependence of our transport system

What is an Infrastructure Bank? Well, the way originally described, its like a piggy bank: put money into it, take money out of it. No leverage at all. However, ideally, the Infrastructure Bank would be set up along the following lines:

- Half of revenue can be committed to long term finance

- Long Term Finance can be interest rate subsidy for loans to self-funding public authorities

- Long Term Finance can be interest rate subsidy for loans refunded through reduced operating costs

- Long Term Finance can be up front grants refunded by a ten year commitment of Infrastructure Bank funding

- If less than half of the revenue from a year is committed, the Infrastructure Bank can provide new Long Term Finance funding

- The balance left after long term commitments are satisfied are provided to "shovel ready" annual oil-independence project funding

Now, suppose there is an oil price shock. Long term, the Oil Industry as a whole would prefer that we maintain our oil addiction and just hand over an ever increasing share of our national income to the Oil Industry. However, short term: windfall to US-based oil production.

Its a strange politics, a logroll that offers

- the Progressive Caucus secure long term funding for oil independent transport, including a substantial increase in funding in the face of an oil price shock to start offsetting the recessionary impact without the recession having to hit first ~ and if the US Department of Transport is aggressive enough in funding projects out of the Infrastructure Bank, quite possibly preventing the oil price shock recession, and

- the Domestic Oil Production lobby windfall gains that only get bigger in the event of an oil price shock

What kind of employment impacts are we talking, here?

Consider the nation's oil import bill for 2009: ~$188b (pdf: p. 9). 1% of that is $1.88b.

Half of that goes to roadworks, half goes to oil-independent transport, half of the oil independent transport funding is annual grant funding. So:

- $1.41b = 3/4 of $1.88b to annual grant funding, and

- $0.47b for long term finance

To keep things simple, assume half the long term finance is interest rate subsidy at 5%, and half is forward funding at 5%. The leverage on the interest rate subsidy is 20x, and the leverage on the forward funding is a bit over 8x, so the average leverage on a 50:50 split is about 14x, leaving:

- $1.41b = 3/4 of $1.88b to annual grant funding, and

- $6.58b in finance from $0.47b funding for long term finance

- For a total of $7.99b in funding in the launch year

Estimates of the employment impact of public transport investment understates the impact of oil-independence investment, since it ignored the stimulus effect of diverting billions of dollars from oil imports into domestic spending. However, taking the American Public Transport Association modeling, the impacts of public transport investment are:

- 8.2 jobs/$m direct job creation

- 7.8 jobs/$m indirect (upstream) job creation and

- 7.7 jobs/$m induced (downstream) job creation, giving

- 23.7/$m total job creation

That is about 190,000 jobs, just from the spending itself. Its only a drop taken from the 14.8m bucket of unemployed, but on the other hand, non-farm payroll employment grew in September by ~150,000, so its more than one extra month of job growth added to the economy before the next election.

The real job impact kicks in when we have an oil price shock. In the face of an oil price shock, the proceeds of the tariff jump upwards, allowing a substantial increase in funding on oil-independent transport. And while the impact on gas prices is current, the impact on transport funding is front-loaded, so that the Oil-Independent Infrastructure Bank adds more to income than the oil price shock takes away.

How many jobs do we get from preventing an oil price shock recession? Hundreds of thousands from preventing the mildest of recessions ~ millions from preventing recessions as severe as the Reagan Recession of 1981 or the Bush Recession of 2007-2009.

Conclusion: Can It Be Done?

I have no idea if it can be done. But its definitely worth a shot.

Midnight Oil ~ The Power and the Passion

You take all the trouble that you can afford

At least you won't have time to be bored.

We are sabotaging our main labor resource with mindless rote learning to pass "achievement" tests to avoid being punished for not being full of kids of upper middle class households, we are allowing our equipment resource to collapse through lack of demand and we are sabotaging our natural resource through treating nonrenewable resources as an excuse to destroy renewable resources and treating renewable resources as non-renewable resources, which is a self-fulfilling prophecy.

We are sabotaging our main labor resource with mindless rote learning to pass "achievement" tests to avoid being punished for not being full of kids of upper middle class households, we are allowing our equipment resource to collapse through lack of demand and we are sabotaging our natural resource through treating nonrenewable resources as an excuse to destroy renewable resources and treating renewable resources as non-renewable resources, which is a self-fulfilling prophecy. And thirty years, we have shifted our record on land wars in Asia from 0-1 with one draw, to at best 0-2 with two draws, and at worst 0-3 with one draw.

And thirty years, we have shifted our record on land wars in Asia from 0-1 with one draw, to at best 0-2 with two draws, and at worst 0-3 with one draw. Last week I

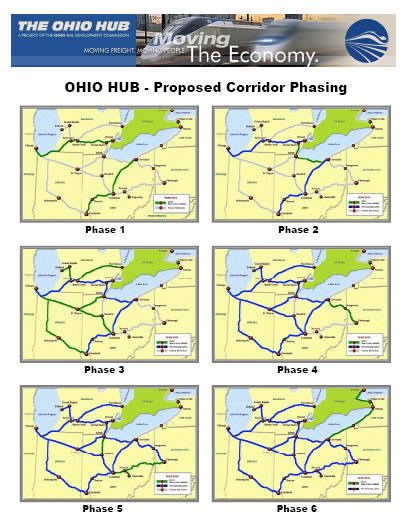

Last week I  For my part, as a Buckeye, where I want the $375m 3C Quickstart Design Money to go is to the Wolverine Line in Michigan. Michigan applied for

For my part, as a Buckeye, where I want the $375m 3C Quickstart Design Money to go is to the Wolverine Line in Michigan. Michigan applied for  As for the Wisconsin $810m (it might only be $740m, if the Governor is clever enough to figure out a way to hold onto the $70m to be spent on the Hiawatha corridor), I'd say start by putting it at the other end of the Empire Builder line, in the Pacific Northwest. Washington

As for the Wisconsin $810m (it might only be $740m, if the Governor is clever enough to figure out a way to hold onto the $70m to be spent on the Hiawatha corridor), I'd say start by putting it at the other end of the Empire Builder line, in the Pacific Northwest. Washington  One of the consequences of the 2010 General Elections was the election of RepubliCorp Governors in Ohio and Wisconsin who politically neutralized the success of sitting Democratic state administrations in landing $400m and $800m High Speed Rail funding by demonizing the High Speed projects that were funded.

One of the consequences of the 2010 General Elections was the election of RepubliCorp Governors in Ohio and Wisconsin who politically neutralized the success of sitting Democratic state administrations in landing $400m and $800m High Speed Rail funding by demonizing the High Speed projects that were funded. Ah, so what about the 3C Quickstart? Why did the State Legislature have to promise to provide up to $12m in operating surpluses over the next 20 years in order for the USDoT to give Ohio $400m to build the 3C Quickstart?

Ah, so what about the 3C Quickstart? Why did the State Legislature have to promise to provide up to $12m in operating surpluses over the next 20 years in order for the USDoT to give Ohio $400m to build the 3C Quickstart? The 3C rail corridor is very much a corridor of two halves. As [http://www.thetransportpolitic.com/2010/11/04/understanding-representative-john-micas-transportation-agenda/#comment-102003 Drewski comments at The Transport Politic]:

The 3C rail corridor is very much a corridor of two halves. As [http://www.thetransportpolitic.com/2010/11/04/understanding-representative-john-micas-transportation-agenda/#comment-102003 Drewski comments at The Transport Politic]:  So, what is a Progressive Populist to make of an election when with a 14% real unemployment rate (see below), where the House changes parties?

So, what is a Progressive Populist to make of an election when with a 14% real unemployment rate (see below), where the House changes parties? Y'all probably know that I am not now nor have I ever been President Obama's biggest fan. In terms of economics, I view him as a Hedge Fund Democrat, or what is known in the rest of the English speaking world as a "neoliberal" (remembering back to 1800's Liberalism, not the mid-1950's Social Liberalism of the US).

Y'all probably know that I am not now nor have I ever been President Obama's biggest fan. In terms of economics, I view him as a Hedge Fund Democrat, or what is known in the rest of the English speaking world as a "neoliberal" (remembering back to 1800's Liberalism, not the mid-1950's Social Liberalism of the US). Not today of course. We can take our time to start. 9 November 2010 is soon enough.

Not today of course. We can take our time to start. 9 November 2010 is soon enough. Best is to eliminate it. Just ax it. But with 50 votes plus Biden to break a tie, the votes are not likely to be there.

Best is to eliminate it. Just ax it. But with 50 votes plus Biden to break a tie, the votes are not likely to be there. Between a new prep this quarter, doing a little last minute election volunteering (phonebanking, poll observing), pitching in with the Tram-Train proposal in Newcastle, NSW, and other ins and outs (like the cold I am just recuperating from) ... the blog has been quiet.

Between a new prep this quarter, doing a little last minute election volunteering (phonebanking, poll observing), pitching in with the Tram-Train proposal in Newcastle, NSW, and other ins and outs (like the cold I am just recuperating from) ... the blog has been quiet. For the Daily Kos edition of this essay, I wrote:

For the Daily Kos edition of this essay, I wrote:

For those who missed

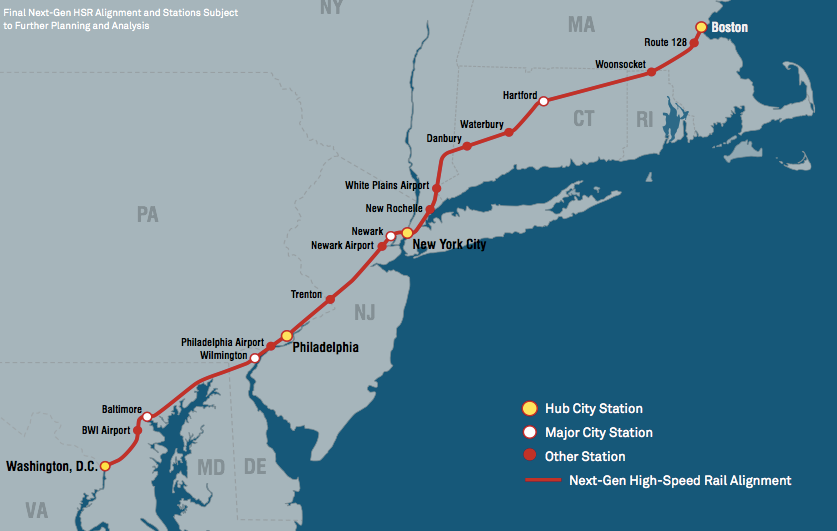

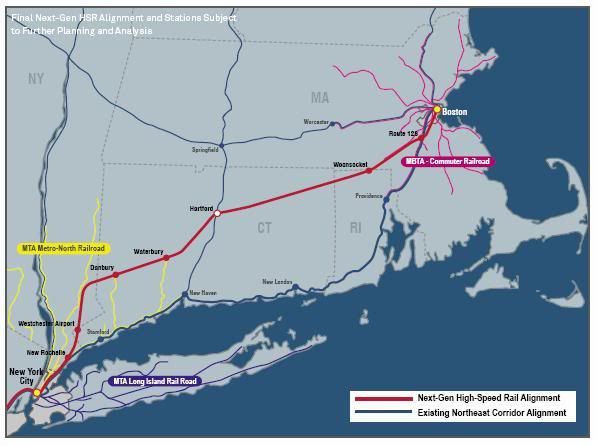

For those who missed  In the Northern alignments, there are three strategies for getting out of New York City:

In the Northern alignments, there are three strategies for getting out of New York City:  There are a similar set of southern alignments, but I expect that the alignments to the east of the NEC can be set aside, which leaves the main contenders as being the "Allegheny" alignment and paralleling the existing NEC. Note that for the Allegheny alignment, the Emerging HSR Philadelphia/Harrisburg or "Keystone" corridor takes on added significance, since a Semi-Express could run NYC/Philalphia and then onto the Alleghany Express HSR via the Keystone corridor.

There are a similar set of southern alignments, but I expect that the alignments to the east of the NEC can be set aside, which leaves the main contenders as being the "Allegheny" alignment and paralleling the existing NEC. Note that for the Allegheny alignment, the Emerging HSR Philadelphia/Harrisburg or "Keystone" corridor takes on added significance, since a Semi-Express could run NYC/Philalphia and then onto the Alleghany Express HSR via the Keystone corridor. Further, the Keystone corridor could be used to connect the (informal) Appalachian Hub to NYC. Long time readers will recall that one backbone of the Appalachian Hub is a Steel Interstate on the Shenandoah Valley & Tennessee corridor. From the northern end of this backbone at Harrisburg, a service could continue down the Keystone corridor to the Alleghany NG-HSR corridor at Westchester PA (see map) and then on to NYC.

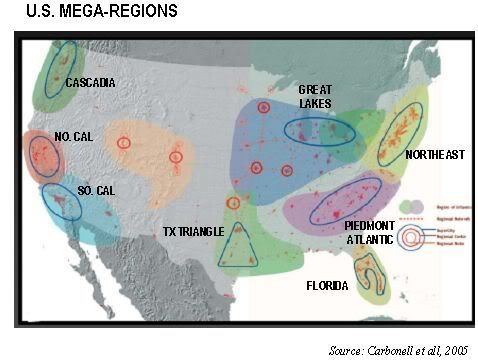

Further, the Keystone corridor could be used to connect the (informal) Appalachian Hub to NYC. Long time readers will recall that one backbone of the Appalachian Hub is a Steel Interstate on the Shenandoah Valley & Tennessee corridor. From the northern end of this backbone at Harrisburg, a service could continue down the Keystone corridor to the Alleghany NG-HSR corridor at Westchester PA (see map) and then on to NYC. As already suggested above, the choice of alignment in the Northeast can affect how easy it is to integrate into the Express HSR corridors from outside of the Northeast. And the map of potential emerging Mega-Regions in the United States gives one indication why that is important: the Great Lakes / Midwestern Mega-Region and the Piedmont-Atlantic Mega-Region are immediate neighbors to the Northeast, and at distances where Express HSR is a viable competing transport option under current energy prices ~ and where even 110mph Emerging HSR will be a viable competing transport option at the energy prices that we may well see in the decade ahead.

As already suggested above, the choice of alignment in the Northeast can affect how easy it is to integrate into the Express HSR corridors from outside of the Northeast. And the map of potential emerging Mega-Regions in the United States gives one indication why that is important: the Great Lakes / Midwestern Mega-Region and the Piedmont-Atlantic Mega-Region are immediate neighbors to the Northeast, and at distances where Express HSR is a viable competing transport option under current energy prices ~ and where even 110mph Emerging HSR will be a viable competing transport option at the energy prices that we may well see in the decade ahead.

This also explains the "takes 30 years". It could be done in substantially less time, but the planning study looked to provide for two segments to be completed by 2030:

This also explains the "takes 30 years". It could be done in substantially less time, but the planning study looked to provide for two segments to be completed by 2030:  The way I put it in the comment thread at The Transport Politic is:

The way I put it in the comment thread at The Transport Politic is:  As

As  Just as the months between the time the Housing Bubble collapsed and the Panic of 2008 exploded, we been focused on providing a liquidity fix to a solvency problem: but this solvency problem is the sustainability of 20th Century Sprawl Suburban Development.

Just as the months between the time the Housing Bubble collapsed and the Panic of 2008 exploded, we been focused on providing a liquidity fix to a solvency problem: but this solvency problem is the sustainability of 20th Century Sprawl Suburban Development. Now, this was a financial solvency crisis, and it has had the devastating real economy impact that it has had because we decided to let it do so ... in addition to not pursuing serious prudential regulation, once the financial solvency crisis hit, we pursued an the under-weight Stimulus II policy, addressing an output gap of $1,000b with a Federal spending stimulus targeted to peak at $250b and which, at present, is only allowing total government spending to tread water, because of a slightly larger drop in state and local government spending.

Now, this was a financial solvency crisis, and it has had the devastating real economy impact that it has had because we decided to let it do so ... in addition to not pursuing serious prudential regulation, once the financial solvency crisis hit, we pursued an the under-weight Stimulus II policy, addressing an output gap of $1,000b with a Federal spending stimulus targeted to peak at $250b and which, at present, is only allowing total government spending to tread water, because of a slightly larger drop in state and local government spending. But none of this was on the basis of growth income ~ since median income growth slowed in the 90's (it took until 1997 to recover the 1989 level, so we only has two years of net growth in the 90's), and stalled in the 2000's, ending the decade lower than it started for the first time since the end of WWII.

But none of this was on the basis of growth income ~ since median income growth slowed in the 90's (it took until 1997 to recover the 1989 level, so we only has two years of net growth in the 90's), and stalled in the 2000's, ending the decade lower than it started for the first time since the end of WWII. The "value" of Housing cannot be higher than what people can afford to pay. What people can afford to pay cannot be higher than their income minus their other necessities. And Peak Oil ensures that the real cost of other necessities will rise so long as we continue Business As Usual.

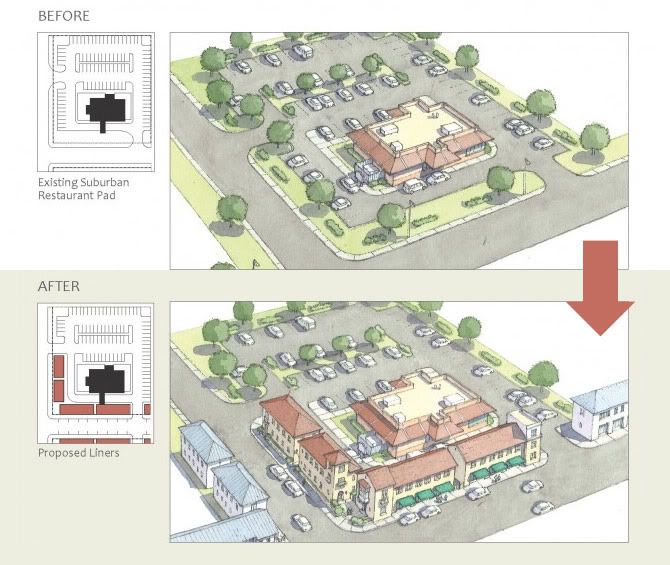

The "value" of Housing cannot be higher than what people can afford to pay. What people can afford to pay cannot be higher than their income minus their other necessities. And Peak Oil ensures that the real cost of other necessities will rise so long as we continue Business As Usual. The key to Suburban Retrofit is the Suburban Village Center. Focused around a stop on a main sustainable regional transport corridor, a Suburban Village Center erases the government restrictions that forbid sustainable development: within a quarter mile radius around the designated primary stop, single-residence, single-use restrictions are removed and replaced by an allowance of at least four occupants per lot including at least one ground floor commercial or professional occupant. An easement of street set-back is allowed, in return for a urban width sidewalk. Minimum parking requirements are eased, allowing for the provision of as much auto-independent residences as the market will bear.

The key to Suburban Retrofit is the Suburban Village Center. Focused around a stop on a main sustainable regional transport corridor, a Suburban Village Center erases the government restrictions that forbid sustainable development: within a quarter mile radius around the designated primary stop, single-residence, single-use restrictions are removed and replaced by an allowance of at least four occupants per lot including at least one ground floor commercial or professional occupant. An easement of street set-back is allowed, in return for a urban width sidewalk. Minimum parking requirements are eased, allowing for the provision of as much auto-independent residences as the market will bear. Note that the Suburban Village can be located in any single use tract. Thus one approach to a Suburban Village is to provided a regional Rapid Streetcar lines that operates primarily on a dedicated alignment, but leaves the alignment to pass through a commercial shopping center. The commercial shopping center then becomes the target for development of the Suburban Village. Common pool parking at the opposing ends of the Streetcar segment allows a reduction in parking available at each establishment, which frees up land for Suburban Village development, including housing.

Note that the Suburban Village can be located in any single use tract. Thus one approach to a Suburban Village is to provided a regional Rapid Streetcar lines that operates primarily on a dedicated alignment, but leaves the alignment to pass through a commercial shopping center. The commercial shopping center then becomes the target for development of the Suburban Village. Common pool parking at the opposing ends of the Streetcar segment allows a reduction in parking available at each establishment, which frees up land for Suburban Village development, including housing.