Discuss this post at:

When Lawrence O'Donnell started berating the woman who received the email from Alan Simpson with this BS (5:05)], I was forced to leave the room until Rachel came on:

When Lawrence O'Donnell started berating the woman who received the email from Alan Simpson with this BS (5:05)], I was forced to leave the room until Rachel came on:It is solvent until 2037.

Workers your age who are contributing to social security every day, we concurrently tell you when your time comes to collect, the money will not be there according to all projections we have today.

"According to all the projections we have today"? First, that is false. Its according to one projection we have today ~ among a range of projections that are made. And second, if Lawrence O'Donnell is going to shift from host to pundit, he is responsible when he uses figures in a misleading way.

Over the fold, how this is wrong, let me Countdown the Ways.

______________________________

Now, before I begin, I must confess that I am an economist, and given the performance of the majority of my colleagues over the past forty years, it would not be surprising if you turn the channel immediately on knowing that.

However, I will say in my defense that I have also been arguing that the majority of my colleagues have been engaging in an anti-scientific approach to understanding the economy for two decades now, since starting grad school in what was then one of the few places you could pursue an PhD while learning from American Institutional economists ... and while I am not a macro-economist, several of American Institution macroeconomists were among those who "called it" as far as the Panic of 2008. Indeed, the Association for Evolutionary Economics has collected a list of economists who are placed among the "nobodies" whenever anyone says, "Nobody Could Have Seen It Coming": Got It Right Project

There Is No Immediate Crisis: Rich People Just Do Not Want to Pay Back Money They Borrowed from Poor People Via Tax Cuts

Originally, the Social Security Trust Fund was set up on a Pay As You Go basis: except for a small buffer, funds coming in covered liabilities. But with demographic swings in the American population, and in particular with growing life expectancies, we looked ahead and saw that when the Baby Boomers started retiring, that would lead to a very high rate of payroll tax.

So Tip O'Neill and Ronnie Raygun reached a deal, where the Social Security rate would be raised, in the early years the resulting surplus would go the General Fund to allow for up front tax cuts, and then when the rate fell behind obligations, the Congress would raise revenues to "pay back" the funds that the Social Security trust fund had lent to the General Fund.

Of course, now that it is nearing time to start paying back, this deal has stopped being a sweet tax deal, swapping higher regressive taxes that rich people do not have to pay for lower progressive taxes that rich people do have to pay, and is entering the flip side of the deal, where the progressive taxes are below Pay As You Go rates, and the funds lent to the wealthy in the form of tax cuts have to be paid back to cover the bonds in the Trust Fund.

Rich People enjoyed borrowing the money from the Trust Fund in the form of tax cuts largely for Rich People. While Borrowing, they were all for the deal. Now that it is time to pay back, they do not like the deal any more.

Now, if we had put this money into an infrastructure fund, we would have a massive amount of infrastructure projects now paying back and it would not be an issue ... but we decided to let rich people borrow it instead. Because we listened to all sorts of BS framing about this deal ... framing mindlessly repeated by people like "Congressional Staffers" (and being a former Senate Staffer with the ability to repeat inside the beltway "expert opinion" is Lawrence O'Donnell's claim to fame) ... instead of seeing this as rich people paying back money they've been borrowing since the mid-1980's, its framed like Social Security is a private insurance fund that is threatened with "insolvency".

So that is the introduction: this is all about Rich People trying to renege on a borrow and pay back deal now that the pay back time is approaching. THAT is the "crisis", not the fictitious 2037 insolvency.

5. The Predictable Movements of the Insolvency Year Projection

The first way that "the projection says its 2037" is BS is that Lawrence O'Donnell, if he checks, will know perfectly well that the projection itself moves in a very regular way. Consider the projection from 2000 to 2009:

- 2000: Payback 2015, Insolvency 2037

- 2001: Payback 2016, Insolvency 2038

- 2002: Payback 2017, Insolvency 2041

- 2003: Payback 2018, Insolvency 2042

- 2004: Payback 2018, Insolvency 2042

- 2005: Payback 2017, Insolvancy 2041

- 2006: Payback 2017, Insolvency 2040

- 2007: Payback 2017, Insolvency 2041

- 2008: Payback 2017, Insolvency 2041

- 2009: Payback 2017, Insolvency 2037

- 2010: Payback, Present to 2011, then 2014, Insolvency 2037

When the economy is in the middle of the deepest and longest recession since the Great Depression (though both Great Depression recessions were deeper and the Hoover recession far longer), the Insolvency year goes down. When the economy is treading water, the Insolvency year treads water. When the economy is doing OK, the Insolvency year goes up.

If a Big Recession like the Panic of 2008 costs us 4 years, and even a sluggish recovery (for the bottom 90% of the income ladder that pays into the trust fund) pushes the year back by half a year or better each year, that means that AVOIDING A REPEAT OF THE PANIC OF 2008 will guarantee that there are still funds in the Trust Fund by 2037.

And, of course, we can avoid a repeat of the Panic of 2008 by adopting policies that ensure it does not happen again. In other words, taking the 2037 year as a "fact" depends on assuming that we won't fix the structural flaws of our financial system.

Someone might say, "but, what is the evidence we will?" ... but the point is, Lawrence O'Donnell pointedly ignored that fact that "fix the massive problems that we created when we started pretending that the Finance Sector can be a sustainable Engine of Growth" as one of the possible "fixes". It was all regressive tax increases or regressive benefits cuts.

4. Projections, with an S. Its Plural. 2037 is just one Scenario

The statement that "according to all the projections we have today" is simply a baldfaced lie. Its not even true according to all the projections done by the OASDI Trustees. The image to the right displays "all the projections" done by the OASDI Trustees for their 2009 report. The left hand line, exhausting the fund around 2029, is the bad economic growth scenario. The middle line, exhausting the fund around 2037, is the intermediate economic growth scenario. And the right hand line, never exhausting the fund, is the strong economic growth scenario.

The statement that "according to all the projections we have today" is simply a baldfaced lie. Its not even true according to all the projections done by the OASDI Trustees. The image to the right displays "all the projections" done by the OASDI Trustees for their 2009 report. The left hand line, exhausting the fund around 2029, is the bad economic growth scenario. The middle line, exhausting the fund around 2037, is the intermediate economic growth scenario. And the right hand line, never exhausting the fund, is the strong economic growth scenario.Obviously, if the optimistic scenario never exhausts the fund, then there is a range of scenarios between "intermediate" and "strong" growth that exhaust the fund in 2040, or 2050.

Even more to the point, the strong economic growth scenario shows just how important the scenarios are. If the fund exhausts sometimes after 2050, it would only represent a small shortfall, since the Baby Boomers will, to put it delicately, start to retire from the status of being social security recipients. If the trust fund exhausts at a time that Social Security tax receipts cover 90% to 95% of entitlements, then it would be entirely possibly to put in a small levy at that time to cover the shortfall, and once the receipts have returned to 100% of entitlement, to then put Social Security back on a Pay As You Go basis.

Well then, there is another "Fix Social Security" policy for you, that Lawrence O'Donnell conveniently forgot to mention: grow the economy. For example, the 10 cent a gallon tariff on imported crude oil that I have proposed to finance investment in oil-independent transport is part of a Social Security Fix.

Its not "on the table" because its a "Bipartisan" commission, and that means that the Republicans and Corporate Democrats who brought us the current slow-growth economic policies are the majority of the Commission. But that is no excuse for Lawrence O'Donnell: he is not bound to respect the slow-growth, wage-minimizing, sluggish investment (and environmental damage maximizing) policies of the "Bipartisan", aka Corporate, Economic Consensus.

Indeed, as seen in Story Number 5, we have had a strong test of how "unbiased" the "intermediate" projection is: the first business cycle without growth in median income since World War II, then followed by the deepest recession since World War II is what was required to keep the projection stable. In 2000, the intermediate insolvency projection was 2037, and in 2010, the intermediate insolvency projection is 2037. So just keep median incomes from falling, in addition to avoiding a repeat of the worst recession since World War II, and the real world track ought to be to the right hand side of the middle projection in the figure above.

3. Its Not One Trust Fund: It's Two

Taking the 2010 report, under current law, the exhaustion of the main Social Security Trust Fund under the (floating and biased low) "intermediate" projection will take place in 2040.

Wait a minute, what about the 2037 figure?

That is a combined figure, combining the main Social Security trust fund with the Disability trust fund. The Disability trust fund is projected to exhaust its assets in 2018. If the law is changed to allow the Disability trust fund access to the main Social Security trust fund assets, then the combined pool will be exhausted (under the biased-low intermediate projection) in 2037. But under present law, that is not allowed, and so under present law, the main Social Security trust fund will be dedicated to the main Social Security entitlement.

There is, in other words, a funding problem to fix, but its in the Disability trust fund. That fact is entirely obscured by Lawrence O'Donnell's beltway-conventional-wisdom driven punditry from the host's chair.

Fix it a different way and exhaustion of the Social Security trust fund is pushed out toward 2040, even under the biased-low "intermediate growth" estimate.

Say, impose a levy on combined unearned and earned income above $250,000, set each year to retain one year's balance in the Disability Income trust fund. Off the table from the "Bipartisan", aka Corporate Majority, Commission, but a perfectly reasonable fix. It avoids a tax increase now, and by transferring income that will be largely directed to accumulating wealth to those who will largely spend it on newly produced goods and services, acts as a mild stimulus when it does kick in.

And of course, if the wealthy were to abandon the policy of holding economic growth hostage to prevent wage increases, the levy would be substantially smaller than under the current approach to economic policy.

2. What About Income Growth

Time for another graph. To the right is median income growth in the US since the mid-1960's, when the Census started keeping track.

Time for another graph. To the right is median income growth in the US since the mid-1960's, when the Census started keeping track.That is the source of the remark I made previous about the Bush Business Cycle having no median income growth, even before the Great Bush Recession pushed the economy into a ditch.

What if we changed that? What would that do to the trust fund? Well, the OASDI Trustee's report does not project that directly ~ they only include it indirectly to the extent that strong economic growth will drive income growth.

But what if we made a "secular" change to that trend, and grew the incomes of people in the middle. That means that the payroll tax taxbase rises, and the trust fund insolvency year steadily climbs up ... remembering that if it hits somewhere in the 2050 to 2060, then there is no problem to be solved, since the Baby Boom demographic bulge will have been bridged. Solving the immediate DI trust fund issue pushes the main Social Insurance trust fund insolvency out to 2040, 30 years from now. We only need to push the year back by an average of 2/3 of a year each year, and we are home free.

So here is another Social Security Fix policy that Lawrence O'Donnell left off the table: pass the cardcheck unionization bill. Increased rates of unionization will lead to higher median income growth, and thus will steadily push back the insolvency year even under the biased-low "intermediate" growth projection.

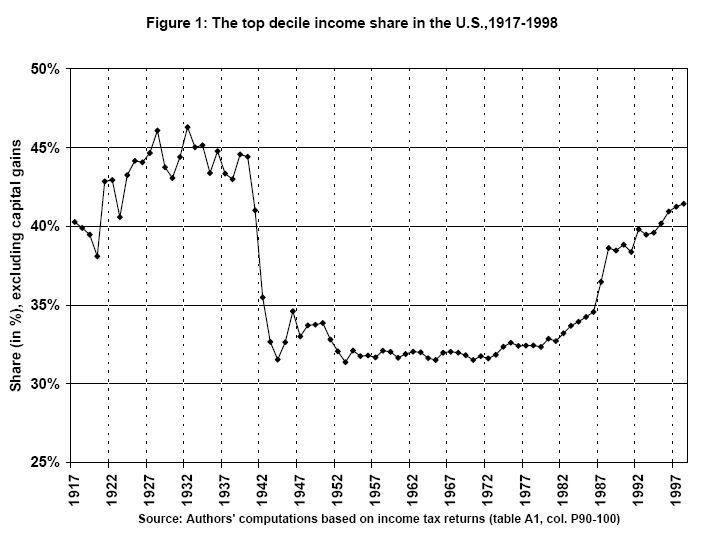

1. Income Inequality

And for the top story this afternoon, consider the graph to the right. The Social Security payroll tax kicks out at $106,800, which means that the bulk of income in the to 10% of the income ladder is outside of the Social Insurance tax base.

And for the top story this afternoon, consider the graph to the right. The Social Security payroll tax kicks out at $106,800, which means that the bulk of income in the to 10% of the income ladder is outside of the Social Insurance tax base.And we have been putting more and more of our national income in the hands of the people who do not pay FICA on the majority of their earned income ~ and of course who pay FICA on none of their unearned wealth income.

According to the Trustees report, if the Disability Insurance trust fund is taken care of, covering the (overestimated) shortfall of Social Insurance will require 1.62% of taxable payroll.

Now the FICA tax rates for the Social Insurance fund are 10.6% (only half of that tax is shown on your paycheck, the other half if taken out of the cost of employing you as an "employer contribution". Of course, since its all considered to be a cost of employing you by an employer, the difference is only cosmetic).

Shifting 9% of US income back from the 10% who largely do not contribute to Social Insurance to the 90% who fund the program ... would be roughly a 9%/58% increase in the "taxable pay" ... which is a 15% increase in the Social Security taxbase ... and 10.6% of that is 1.59%, or almost the entire amount of the (over-estimated) projected shortfall.

So:

- 1. going back to the income distribution that the US had when we gained the status of the wealthiest nation on the face of the earth, rather than the income distribution we have had as we lost that status ... basically closes the hole entirely

- 2. Restoring median income growth will certainly reduce and has the prospect of closing the hole

- 3. Fixing Disability Income without putting a brake on growth with regressive tax increases or benefit cuts closes the only part of the problem that threatens to hit this coming decade

- 4. Reversing our slow-growth income policies will certainly reduce and getting even halfway to the fast-growth scenario would likely close the hole entirely and

- 5. Avoiding a Second Great Recession in the next thirty years will reduce the hole substantially over the next thirty years.

Without a single regressive tax and without a single regressive benefit cut, that is reducing the hole one ways and closing the hole entirely three ways.

So the next time Lawrence O'Donnell tries this shit, hit him back with a shitstorm of calling him on his bullshit. Hit him here, hit Countdown's email, hit twitter, hit facebook ... whatever social media you are connected to, hit it. The fix is in and unless we call them on it, it will stay in.

Midnight Oil ~ Power and the Passion

You Take All The Trouble That You Can Afford

At Least You Won't Have Time To Be Bored

This week in The New Republic, Richard Florida

This week in The New Republic, Richard Florida  There is much that is right and much that is wrong in Florida's argument. One of the signal failings of the story as he presents it is presenting the 20th Century Growth Engine as some kind of natural force, ignoring the substantial entrenched policies that channeled it down the particular paths it took.

There is much that is right and much that is wrong in Florida's argument. One of the signal failings of the story as he presents it is presenting the 20th Century Growth Engine as some kind of natural force, ignoring the substantial entrenched policies that channeled it down the particular paths it took. Now, the Interstate Highway System, while not the majority of the cross-subsidy for sprawl development, were an integral part. But for passenger transport, "Interstate Highway" is a misnomer. The bulk of the passenger miles on the Interstate Highway system are local passengers, not interstate passengers.

Now, the Interstate Highway System, while not the majority of the cross-subsidy for sprawl development, were an integral part. But for passenger transport, "Interstate Highway" is a misnomer. The bulk of the passenger miles on the Interstate Highway system are local passengers, not interstate passengers. ... or Virginia or Illinois or upstate New York or North Carolina or Washington and Oregon or ...

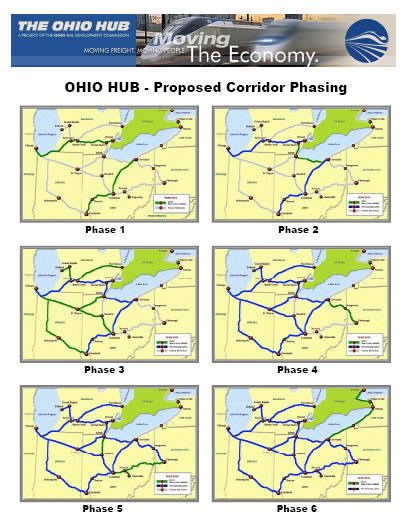

... or Virginia or Illinois or upstate New York or North Carolina or Washington and Oregon or ... Fast forward to the 90's. While the Clinton administration lobbied hard to signed President George H.W. Bush's NAFTA agreement into law, it also pushed through a High Speed Rail bill that set up a system of state based High Speed Rail commissions, with enough funding to basically fix up a few of the most dangerous level crossings around the country. Ohio got its High Speed Rail Commission, and went back to the drawing board.

Fast forward to the 90's. While the Clinton administration lobbied hard to signed President George H.W. Bush's NAFTA agreement into law, it also pushed through a High Speed Rail bill that set up a system of state based High Speed Rail commissions, with enough funding to basically fix up a few of the most dangerous level crossings around the country. Ohio got its High Speed Rail Commission, and went back to the drawing board. The argument about the train being slow often goes, "we should jump straight to HSR". And, indeed, if it would have been supported by the Republican State Senate, it certainly should have been.

The argument about the train being slow often goes, "we should jump straight to HSR". And, indeed, if it would have been supported by the Republican State Senate, it certainly should have been. Of course, this is selecting examples of European countries pursuing expanded wind power based on which ones are having macroeconomic problems, not based on which European countries are most aggressively pursuing wind power.

Of course, this is selecting examples of European countries pursuing expanded wind power based on which ones are having macroeconomic problems, not based on which European countries are most aggressively pursuing wind power.  There is, however, a common energy thread that does tie these countries together, but its not wind power penetration in electric markets. As Luis de Sousa reported in The European Tribune in April, in

There is, however, a common energy thread that does tie these countries together, but its not wind power penetration in electric markets. As Luis de Sousa reported in The European Tribune in April, in  The big news from July was:

The big news from July was:  The electric transport fund is divided into state-based accounts, so that, for example, if the following states borrowed the full ten years ahead (based on 2009 Census estimates):

The electric transport fund is divided into state-based accounts, so that, for example, if the following states borrowed the full ten years ahead (based on 2009 Census estimates):  The Sunday Train has covered

The Sunday Train has covered