Crossposted at: Docudharma,

ProgressiveBlue,

The Economic Populist,

Congress Matters,

Agent Orange.

Burning the Midnight Oil for the Next American Revolution Jerome a Paris

Jerome a Paris at the European Tribune

focuses in on the central problem of the

Financial crisis, and therefore the central problem of the

Bail-Out:

But, pontificating aside, the reality is that we had a large scale grand robbery of the past few years. To make it simple: the Fed printed money, gave it for free to rich people, who lent it to poor people at at nice profit instead of paying them wages; reimbursement was possible only if house prices went up, and that lasted for a while. The rich made out like bandits on their assets, financial or otherwise, and the poor thought they were more or less keeping up with the Joneses (the reality was a large-scale transfer of wealth from one group to the other, no bonus points for guessing which was which). Now that it's no longer the case, the poor lose their house, stop paying their debt at some point, put the banks in a pickles, and the economy unravels. Except that the banks are being bailed out, which means, fundamentally, saving the owners of financial assets (bank bondholders specifically, and bond holders in general) at the expense of taxpayers, thus having the goverment validate and consolidate the past transfer of wealth.

So

leverage is the central problem ... or rather, the central problems:

- For those looking to hold onto their ill-gotten gains, how to maintain the maximum amount of wealth while they deleverage, which means how to convert what was always in a large part fantasy wealth into actual claims on actual productive capacity

- For the other 99% of us, how to prevent those who obtained fantasy wealth from converting it into real wealth at our expense

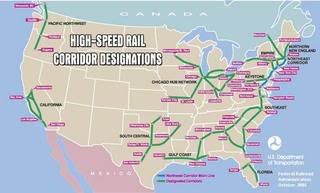

Now, there is lots of government spending that increases our leverage, and lots that reduces our leverage. Investing in Energy Independent Transport, Housing and Agriculture, for example, would be "debt" with a net pay-off for the economy, and therefore is an increase in our debt

totals that would, over time, reduce our net debt

burden.

On other other hand, subsidizing people going into debt to buy houses and cars - there's little long term benefit to point to there. Those are programs that only work as short-term stimulus by making the long term problem worse.

And handing out tax cuts ... especially tax cuts to those who are trying to convert their fantasy wealth into real world wealth at the expense of the rest of us ... has less than $1 stimulus impact for each $1 in handouts to the rich, so its clearly an

increase in leverage.

However, these are just finger exercises, getting warmed up for the big looming fight to convert fantasy wealth into real wealth ... the fight coming over TARP 3.0.

Now is the Time to Organize for Tarp 3.0The

Washington Post (h/t

Kagro X at Congress Matters) lets us know that Tarp 2.0 is going to be pursued within the limits of the $350b already appropriated for the bail-out. And it included the note that:

Congressional sources added that if the programs developed by the Treasury were not successful, they expect the administration to return to Capitol Hill to ask for more rescue funds.

Obama addressed this issue at the news conference. "We don't know yet whether we're going to need additional money or how much additional money we'll need until we've seen how successful we are at restoring a sense of confidence in a marketplace that the federal government and the Federal Reserve Bank and the FDIC, working in concert, know what they're doing," he said.

And someone in putting together Tarp 2.0 has been reading over my shoulder. That is:

If these large banks receive federal aid, they would be subject to tougher conditions than the Bush administration imposed and be required to submit reports to prove they are using the aid to do more lending.

And the tougher conditions?

They would be banned from using government funds to pay dividends above a penny or buy healthy firms until the government investment is repaid.

A Beautiful Financial Rescue Plan on 10 October, 2008:

But like a debt, voting shareholders cannot take a dividend for themselves unless they have paid the Preferred dividend in full. ...

I'll add another rider ... because a lot of time income is taken out as part of Mergers and Acquisitions activity rather than dividends ... the Public Trustee must approve any Merger and Acquisition activity unless the Preferred Shares have been fully paid for two fiscal years.

Today's announcement:

Their chief executives would face compensation restrictions that would limit their annual pay to $500,000. Any compensation above that could come only in the form of stock that could not be sold until the federal loans are returned.

A Beautiful Financial Rescue Plan on 10 October, 2008:

The Preferred Shares have a condition attached that, whenever the firm is not paying the Preferred Dividend, the only executive compensation allowed that is more than 10 times median income are common stock options maturing in five years or more.

But of course, its a bit like its cherry-pit picked, in that some of the sweetest parts of the Beautiful Rescue Package were left behind, including the Trustee

holding onto the Senior Preferred Shares, receiving, in ordinary times, a stream of income allowing it to retire the bonds used to finance the package ... and the strings attached to the Senior Preferred share kicking back into action anytime the financial institution is in a position that is cannot pay the Senior Preferred Dividend in full.

That is, the Beautiful Rescue Package was designed with one eye to the possibility that this is not just a temporary, if severe, aberration, but instead that we may be facing rockier times ahead than we have experience in the past half century.

However, that is water under the bridge ... the Congress passed a plan with close to no strings attached, and the fact that we have an Administration that is willing to tie some form of the three strings that are obviously required is far better news than we have been accustomed to over the past eight years.

What I want to do now is look ahead to Tarp 3.0, since given the state of the economy, and the difficulty that healthy banks would have earning income in this economic environment, its highly likely that the $350b of Tarp 2.0 will get spent and we will still have some bailing out to do.

And what we have to focus on is making sure that the Financial Rescue package does not interfere with our ability to make useful public investments. We are already seeing long term Treasury rates rising above the floor that they hit in the middle of the Banking Panic of 2008, as we are looking to finance the Economic Stimulus hard on the heels of the finance of the Wall Street Bail-Out.

Hoisting the Bastards on their Own PetardNow, under US political institutions, we have an opportunity to engage in smart investment in the upcoming budget bills, and given the gross inefficiencies built into our economy by decades of welfare for the rich, can do it on a basis that can be passed with 50 votes in the Senate.

The challenge is to come up with a financial system "bail-out" package that has a substantially smaller debt footprint. Given the public outrage over Tarp 1.0 and 2.0, the most politically feasible approach may be one that taxes the wealthy to fund the bail-out.

And ...

given PAYGO legislation put into place by the Conservative Movement (h/t Kagro X aka David at Congress Matters) ... if the bail-out is in a budget bill that taxes the wealthy to fund the bail-out, that only needs 51 Senators to pass ... budget bills are not subject to filibuster, and balanced-budget bills are not subject to the PAYGO waiver requirement which also has a 3/5 majority required.

So the Conservative Movement with its politically adroit PAYGO legislation, designed to starve public investment in social infrastructure, may well mean that the easiest way to get a "TARP 3.0" through the legislative process is by designing one with the wealthy paying the bill.

And that is an objective well worth organizing for. Because the more we finance the financial system bail-out on the backs of the wealthy, the deeper will be our ability to borrow to in the future of our nation.

So leverage is the central problem ... or rather, the central problems:

So leverage is the central problem ... or rather, the central problems: A computer is not a "technology". The ability to make a computer, and to program it to do something, is "technology". Techno Logos. Technique Words. Knowledge of Techniques. And so our technology is intrinsically social, since human capabilities are intrinsically social.

A computer is not a "technology". The ability to make a computer, and to program it to do something, is "technology". Techno Logos. Technique Words. Knowledge of Techniques. And so our technology is intrinsically social, since human capabilities are intrinsically social. After all, the illusion that human societies in general -- and technology in particular, which is an important aspect of human society -- are under our control depends upon people's perception that the rules of behavior that they are accustomed to are the "natural" and/or "right" ways of doing things. So, perhaps it is the accelerating pace of technological change that dispels the illusion that we are in control of our societies. If so, this is something we have been on the road to for quite a long while, since technological change has been accelerating for the last 5 millenia at least.

After all, the illusion that human societies in general -- and technology in particular, which is an important aspect of human society -- are under our control depends upon people's perception that the rules of behavior that they are accustomed to are the "natural" and/or "right" ways of doing things. So, perhaps it is the accelerating pace of technological change that dispels the illusion that we are in control of our societies. If so, this is something we have been on the road to for quite a long while, since technological change has been accelerating for the last 5 millenia at least. BTW: the only deep ecology dream I could dream at the spur of the moment was pretty shallow: I walked to the local store, and bought a cherry muesli bar. Cherries, after all, were in season. I went back to work on the university computer, and that's all, there is nothing else. To be specific: there was no garbage can in the office to throw the wrapper "away", no hint of the notion that there is an away to throw thing to, and, therefore no wrapper; therefore no wholesaler; therefore no delivery truck; therefore no big meusli bar factory; therefore no surprise that the person who made them dropped them off on their way to Uni. Etcetera, Etcetera, and so forth.

BTW: the only deep ecology dream I could dream at the spur of the moment was pretty shallow: I walked to the local store, and bought a cherry muesli bar. Cherries, after all, were in season. I went back to work on the university computer, and that's all, there is nothing else. To be specific: there was no garbage can in the office to throw the wrapper "away", no hint of the notion that there is an away to throw thing to, and, therefore no wrapper; therefore no wholesaler; therefore no delivery truck; therefore no big meusli bar factory; therefore no surprise that the person who made them dropped them off on their way to Uni. Etcetera, Etcetera, and so forth.