On Agent Orange, bonddad writes:

On Agent Orange, bonddad writes:Among the most important of the rules Rosie laid down, in my opinion, is #12: Get the US consumer right and everything else will take care of itself. The reason is fairly simple: The U.S. consumer has the biggest balance sheet on the planet. The U.S. consumer represents 70 percent of our GDP and about 18 percent of global GDP.

This is, however, following the entrenched habits of thought that got us into this mess in the first place. In a comment in reply, I write:

The problem with the 70% figure ...

... is that only a portion of that is free-standing spending, that is not financed out of income. Sustainable growth in aggregate demand occurs when there is a sustainable increase in spending that is not financed by income ... because the portion that is financed by income follows growth in incomes, it cannot lead growth in income.

If we are importing roughly 1/5 of our GDP, 15% of that consumption is imports and 55% is domestic.

If our income-expenditure multiplier is around 1.5, that implies about 2/3 leakages, 1/3 income financed consumption of domestic goods and services. So 55%-33%= about 22% debt-financed consumption of US goods and services that acts as a domestic growth driver. The rest of the 70% figure is domestic recirculation of income and income spill-over to the rest of the world.

Now, that is still a big chunk of change, and under Bushonomics, with the anti-export and anti-real-investment policies that were in place, was the main growth driver we were counting on.

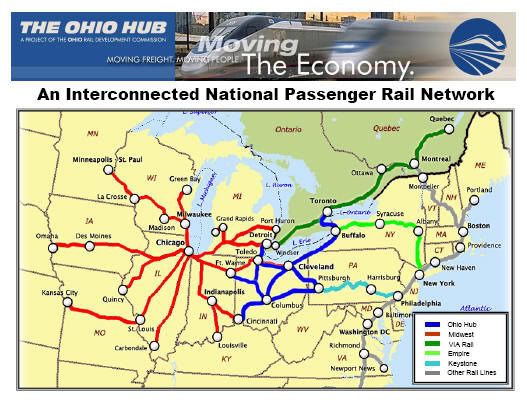

However, it is clearly a growth driver that we can replace if we pursue an aggressive plan of government investment in energy efficiency and infrastructure in support of sustainable energy independence, combined with government policies that ensure ongoing growth in private investment in energy efficiency and production of energy for sustainable energy independence.

And unlike the growth regime founded on unsustainable increase in degree of leverage, its a growth regime founded on the real increase in both the quantity of domestic resources and the efficiency with which they are used.

Certainly, as our economy has evolved in the past three decades, debt-financed consumption has become the largest of the four sources of new injections into Aggregate Demand:

Certainly, as our economy has evolved in the past three decades, debt-financed consumption has become the largest of the four sources of new injections into Aggregate Demand:- Government spending, which creates new fiat-currency

- Real investment in new productive capacity, which is based on newly created credit-money

- Debt-financed consumption, which is based on newly created credit-money

- Exports, which is based on either kind of newly created money, depending on the source of the domestic currency flows into the foreign exchange market that were the ultimate source of the domestic currency paid for the exported products

The Brawny Recovery strategy shifts the focus, toward the transitional economy in which investment in the foundations of a sustainable economy are the source of new aggregate demand.

1 comment:

Lovelyy blog you have

Post a Comment